No time to read now?

-> Download the article as a handy pdf

List of contents

Will the size of pharmacovigilance really grow?

Part 1 – Why the basis for market forecasts may be flawed

Dominik Hodbod | Sep 24, 2025

In a true Tepsivo spirit, my position will be in direct contrast to what most of the industry believes. I don’t think the PV industry will grow. I think it will shrink.

Well, let’s rephrase that. I think it should and absolutely can shrink (as I already touched on in a post from over 2 years ago). Am I boldly making the prediction that this is what actually will happen? Unfortunately, no. To put it simply, if enough people in the industry want pharmacovigilance to grow, then they will probably find ways for it to grow.

But is that inevitable? No.

For those who care about inflating budgets and costs needlessly spent on activities that are long obsolete or entirely unnecessary, there is an alternative approach.

Naturally, it is the approach my company has been advocating for and actively implementing since 2020. So, you may read a hint of bias in this post, but that will probably always be the case. Maybe I am pushing an agenda, but I think that is okay. After all, we don’t preach water and drink wine.

In any case, with the bias acknowledged, the following is my own viewpoint based on insights and experience as an industry insider, but it does not presume to be a formal industry analysis.

This first part looks at the PV industry size today, why we should care about it, what “Glut” is, and how big PV should be today before taking into account future developments.

The second part will then look at some key arguments about why the PV industry is set to grow.

Where are we today?

Size of the market

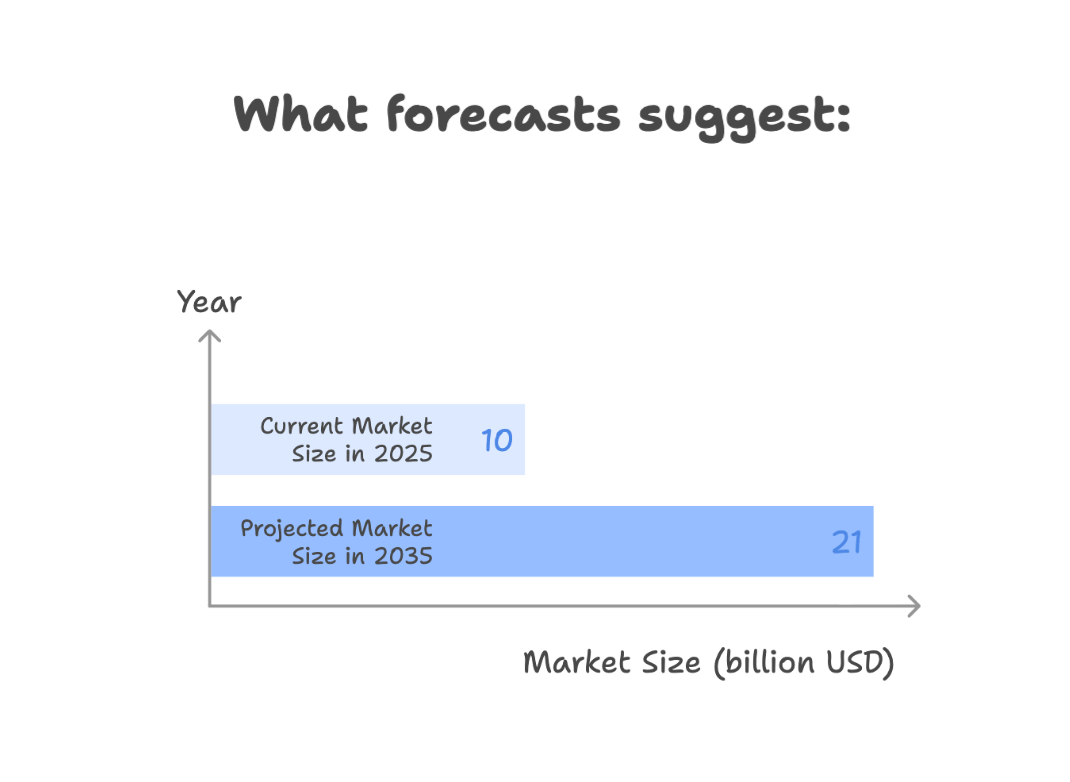

Most estimates (see list of resources below) put today’s size of pharmacovigilance market at around 9-11 billion USD and forecasting growth to about 20-22 billion USD within 10 years (with some lower estimates near $7b and $15b, respectively).

In each case, they seem to be aligned in the prediction that by 2035, the total size of pharmacovigilance will have doubled.

In each case, they seem to be aligned in the prediction that by 2035, the total size of pharmacovigilance will have doubled.

Well, does it really have to?

What is pharmacovigilance as an industry?

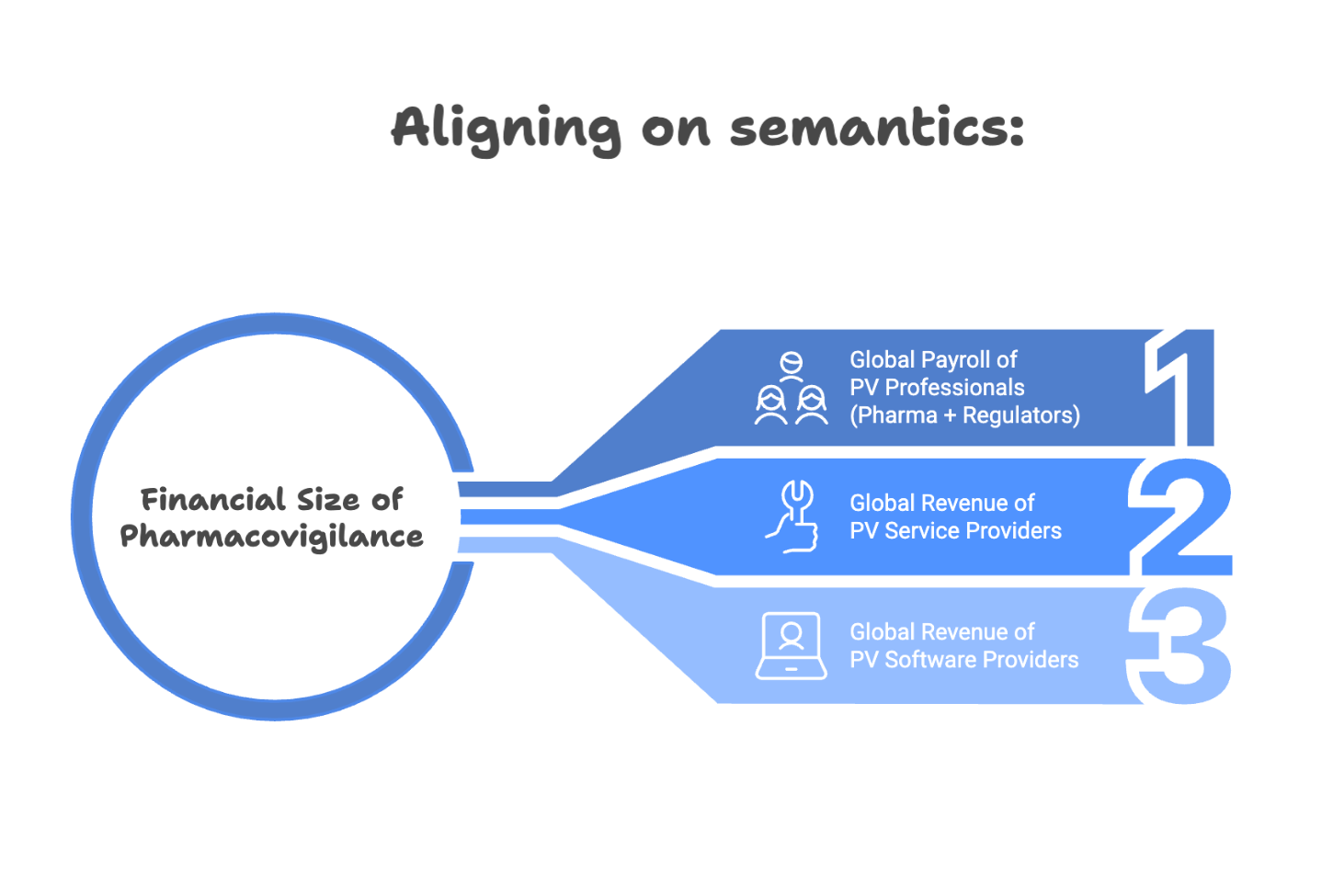

First, let’s align on the semantics.

When I talk about the pharmacovigilance industry and consider its financial size and future, I am thinking of:

- Global payroll of PV professionals employed by pharmaceutical companies and regulators

- Global revenue of all pharmacovigilance service providers generated by pharmacovigilance services

- Global revenue of all pharmacovigilance software providers generated by sales of pharmacovigilance software

Combined, these should give us a good picture of what it costs to maintain adherence to legal pharmacovigilance requirements around the globe.

Combined, these should give us a good picture of what it costs to maintain adherence to legal pharmacovigilance requirements around the globe.

This is probably far from perfect math but it should be enough to paint the picture of what the size is and what it can be.

A few side notes: I’m not really considering the total revenue of companies providing pharmacovigilance services as part of their portfolio.

Quite often, at a certain stage of their journey, it makes good sense for these companies to branch out in other areas and add sales in new service lines (or PV being one of the new verticals of a CRO, let’s say). That is already the case for many, of course. So – with an obvious bias emphasized here – let me say that the size of the PV industry in the sense of “PV companies” is likely to grow through pivoting to new areas over time. But that shouldn’t be the case for pharmacovigilance services only.

Similarly, many pharmacovigilance professionals employed by pharmaceutical companies have wider responsibilities in the company, so their value to the firm is distributed among different areas. So, the statistics on global payroll will not be a perfect fit to the logic here, but overall, it should not distort the main trends.

Also, the fees paid by license holders to regulators such as EMA are not considered here (or other income). For the logic pursued here, I am more interested in the cost of maintaining a global PV system (agency payroll and agency costs on software) rather than how that bill is footed.

Why should we care about the size of the PV industry?

Total cost of adhering to pharmacovigilance legal compliance is what we should be interested in if we care about value creation. For us, applying the principles of value-based healthcare to pharmacovigilance has been a key goal since 2020. In fact, it has been the main goal.

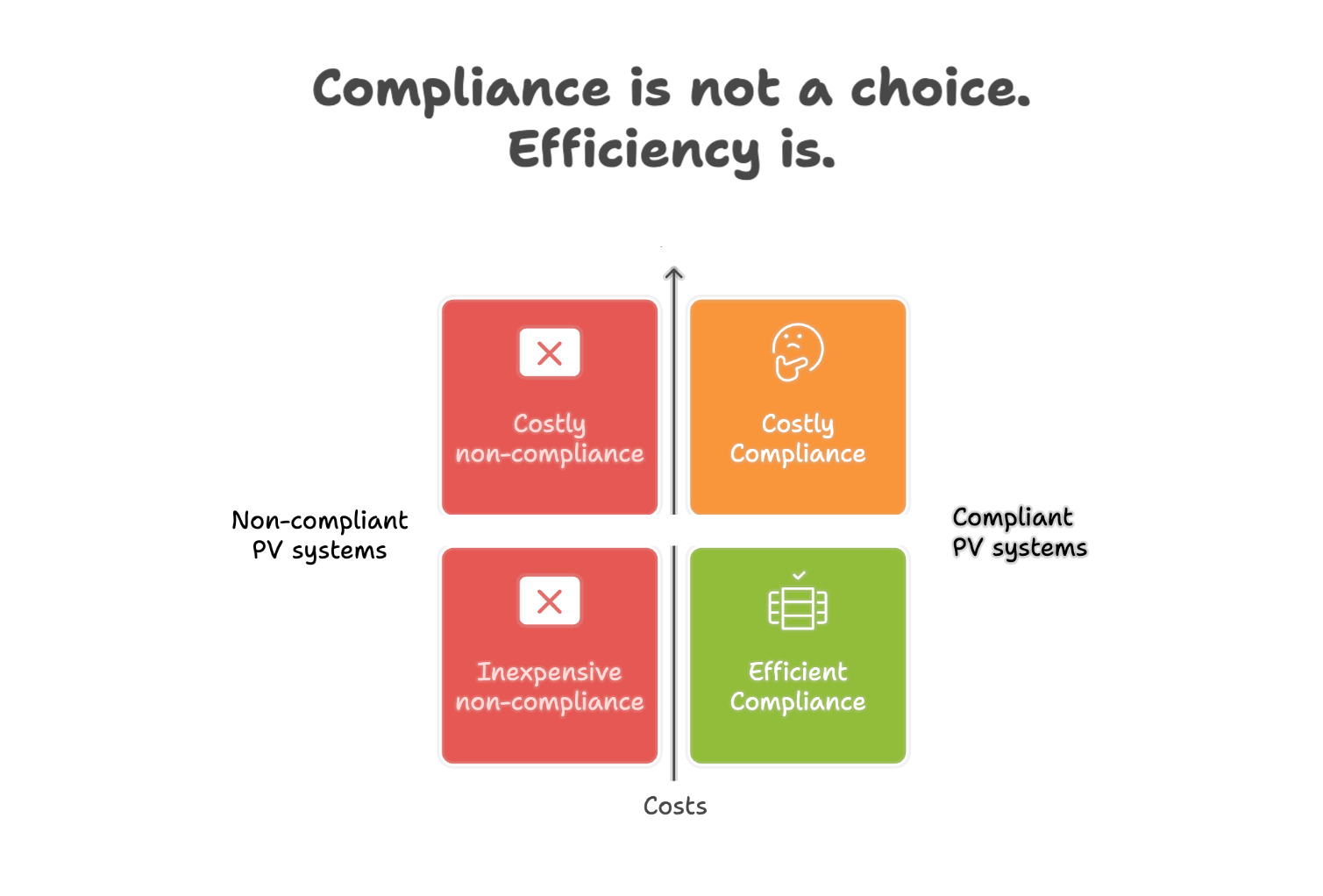

Meeting regulatory requirements for the safety and efficacy of medicines (PV requirements) is a black or white world. You either comply or you fall short with those. There is nothing in between. So, for a PV professional and any serious PV provider, compliance with regulations should be the baseline.

The question is, how do you make it happen? How effective can you be? Do you need a large budget to assure legal compliance? Or can you reduce the pharma company’s costs that are one way or another baked into the prices of medicines and in some way passed onto patients (obviously, at very different levels country by country, but let’s leave that for another day).

And, so, that is where you can create value and why you should care about the size of the industry.

And, so, that is where you can create value and why you should care about the size of the industry.

In fact, this is the logic that led me to the key motto for Tepsivo service when we were starting out: 100% legal compliance at the lowest possible cost. Still our key message today.

My co-founder, and an avid blog writer, Martti Ahtola was writing about the topic back in 2021 already and his conclusions still ring true nowadays, too.

Some people may take the view that pharmacovigilance expenses are not really the biggest concern for pharma companies and play a minor part in the big scheme of things and total costs. To me, that is too cynical. That is kind of like saying it’s okay to tolerate pocket thieves because there are serial burglars in town. Neither should be tolerated.

So, clearly, we have always cared about reasonable size of pharmacovigilance industry. Have others?

What is the size today and what should it be?

Let’s go back a bit.

As I said, the total global payroll on PV professionals directly employed by regulators and pharmaceutical companies plus PV services and software revenue of providers is the total that we should view as the global cost of pharmacovigilance.

Now, a question with the world’s least surprising answer is:

“Is the current total global spend on PV what it can cost?”

The answer is obvious, but the question is fundamental. Before we start considering what the future of pharmacovigilance will look like, should we not address first what it already could be today?

Ok – just in case it wasn’t obvious. Here is a made-simple depiction on how I see the financial size of the PV industry.

Global PV Compliance Cost = total cost on assuring regulatory compliance around the world (what it should be)

To reiterate:

Global PV Compliance Cost = Global payroll on agency jobs and industry jobs in PV + Global revenue of service providers in PV + Global revenue of software providers in PV

Now…

Global PV Compliance Cost ≠ Global Real Spend on PV

(what it really costs today)

Why?

Because…

Global Real Spend on PV = Global PV Compliance Cost + Glut

And…

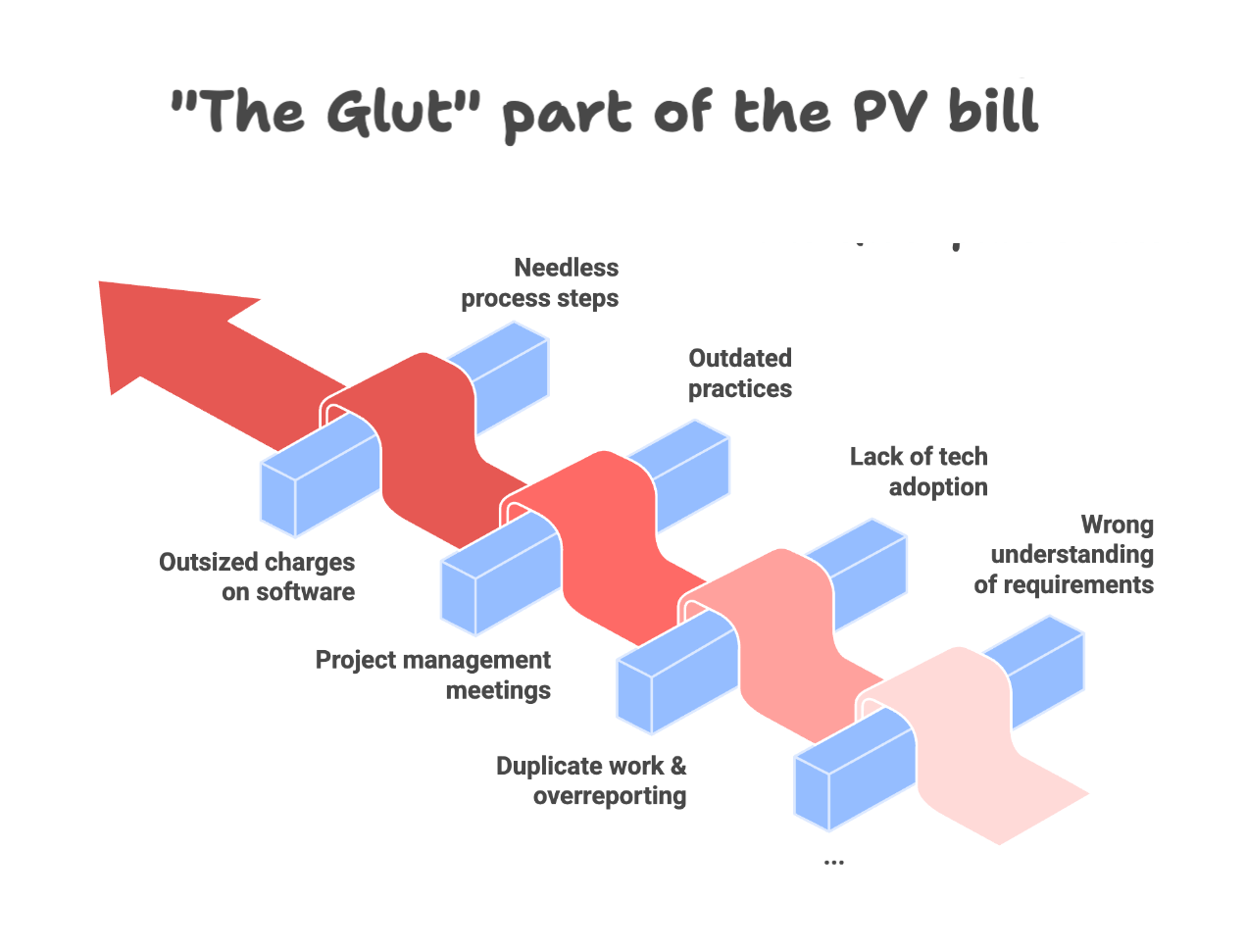

Glut = overabundance of work through lack of tech adoption + outdated standard industry practice + needless process steps + “PM” meetings + massive mundane admin work + overreporting of cases + duplicate work + wrong understanding of regulatory requirements + outsized charges on software + X (of many other examples)

This is very simplistic and at this stage, I think my point is clear.

Over the years, we’ve shared our ideas on why such Glut exists (pointing fingers mainly at traditional PV providers) and we are very likely to release a couple of posts addressing this further. But let’s not get too distracted now.

In an “ideal”, value-based healthcare type of world of pharmacovigilance:

Global Real Spend on PV = Global PV Compliance Cost.

Glut is removed in such utopia (and yes, I acknowledge it’s an utopia most likely). But for those who care about value, it is the end-goal worth striving for (as Tepsivo does).

Where can we be tomorrow? And where will we be?

Is the basis for growth forecasts right?

If there is a substantial discrepancy in the total financial cost between what is possible and what reality is today, do those who forecast PV industry growth take that imbalance into account for the future, too?

Are they considering a world where those gaps are closed?

My best guess is they don’t. Most arguments about the future growth of the industry revolve around the increasing size of the larger pharmaceutical industry, growing number of medicines, tightening regulations, technological progress, and further added value of PV in specialized areas (probably not pharmacovigilance anymore).

In other words, these forecasters don’t pause before the predictions to look at the world today and take into account that the current size of the industry is substantially larger than what it can (and for the “value-creators”; should) actually be.

Or, perhaps, these forecasts do take all of this into account, but they simply assume that the industry largely driven by service and software providers is not primarily motivated by value-creation but rather “invoice creation”, so they will always find ways to grow the sales, as I mentioned in the beginning.

Or, perhaps, these forecasts do take all of this into account, but they simply assume that the industry largely driven by service and software providers is not primarily motivated by value-creation but rather “invoice creation”, so they will always find ways to grow the sales, as I mentioned in the beginning.

Personally, I think this is a cynical view. To reiterate, PV companies should grow and I think they will (Tepsivo among them), but they should grow in creating value, which at some point means branching out of PV. But within pharmacovigilance itself, the value creation should mean reducing the total cost on PV. After all, there is nothing above 100% compliance.

What if we remove “the Glut”

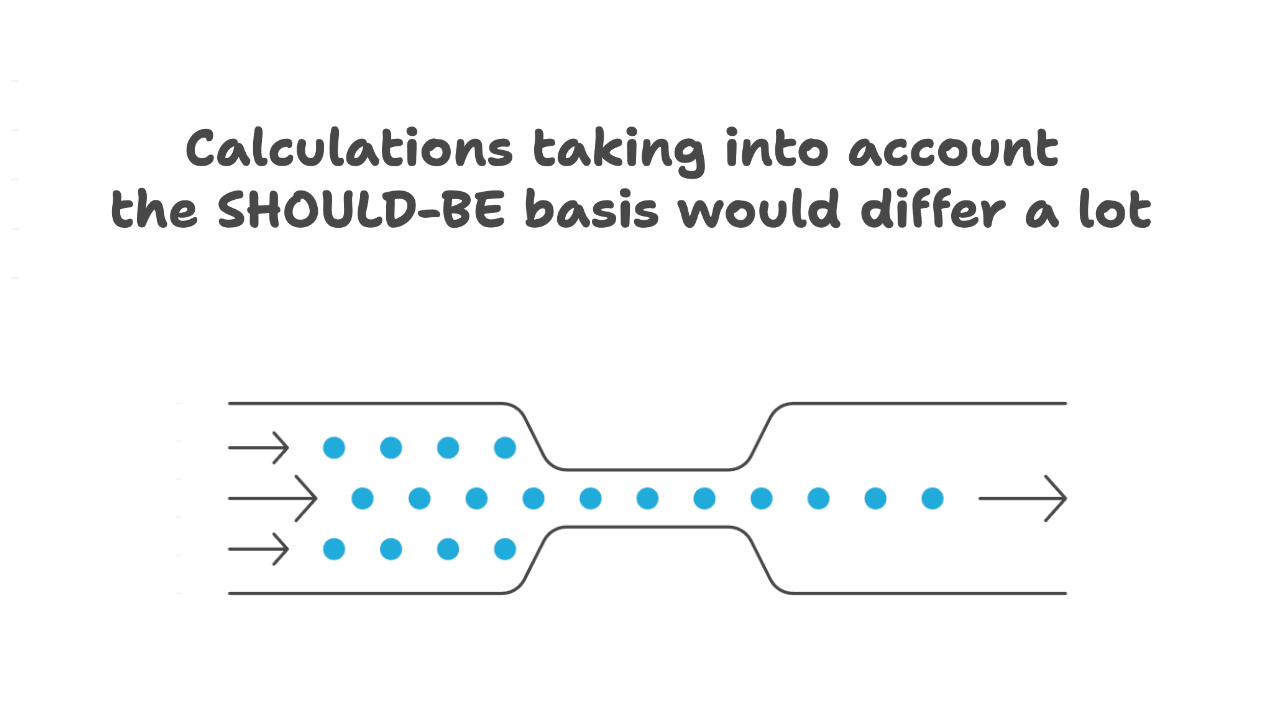

I will break down the “growth” arguments below. But, even before we consider if and why the PV industry should be growing, let’s just assume that it really will. Let’s assume that it really doubles in 10 years as most forecasts seem to predict.

Let’s assume that, but let’s also remember the factor of Glut in the whole equation. Let’s just say, for the sake of the argument, that we in fact remove the Glut from Global Real Spend on PV. And let’s assume we already do it today. We do it with currently available technology right now, so not even considering future developments.

Just for the sake of the argument, I believe that the below is roughly accurate:

Global Real Spend on PV =

⅓ of Global PV Compliance Cost + ⅔ of Glut

Yes, all you math nerds, I know this isn’t the right mathematical logic, but I want something simple enough.

And yes, I’m saying that roughly 66% of all existing costs on PV can be removed, today.

This can be done if automation efficiency gains are translated into cost savings, scientists dedicate their time to value-added tasks (see my earlier post), MAHs and sponsors avoid “additional” industry practices on top of real regulatory compliance, software costs reflect value created, and, overall, the industry moves to a value-based approach as I have outlined before.

At Tepsivo, these are all steps we take and as a result work with total budgets of roughly 30-40% of the market rates, especially at larger scale (see some case studies). This naturally informs my estimates on total “Glut” (and, again, I’m relying here on my own knowledge and insights).

If you’re skeptical about these numbers, just ask anyone in the trenches of a PV process about their day to day and see how much of their time is still in repetitive work, or work related to a process to which you’d be hard pressed to find any justification in the PV legislation. Or ask yourself what is the value behind the price tags of many software solutions. Or look at PV providers’ invoices and look for “ad hoc hours” or “units” (e.g., cases), which can give you an idea of their incentive to bill these.

Conclusion

In any case, it is not really important whether we can now remove 66%, 50% or 30% of costs. The main point is that we can indeed remove a lot. The current size of the industry is inflated.

So, if we were able to deflate the industry, it can very well still double within 10 years, but overall it will not have increased from today’s size. It may even be smaller, hence my logic in the argument that PV will shrink.

Should you care about any of this? Well, that is really up to you and I don’t presume to know, but here’s why I think you may want to care.

If my words resonate, then I think you care about creating value in the industry or, more pragmatically, care about company’s budgets.

If you care about compliance, I think you should care about the most efficient way of delivering it. And I hope that most understand that the technological efficiencies and reduction of human involvement leads to better precision, and much lower human error, meaning higher compliance rates. That is the logic behind 100% compliance at the lowest possible cost.

If you care about patient safety (probably all readers do), then I will argue you should care about how focused the PV scientists are on things that really matter. I think you should care that scientists do actual science instead of all the Glut.

If you, conversely, believe there is a positive link between money spent and quality of service (“more expensive must be better”), then I would encourage you to get in touch with us, and we’ll try to change your mind.

On a final note, just in case anyone started to wonder. I am an entrepreneur and advocate of capitalism, so I understand the desire for things to “grow”, especially in a financial sense. But, maybe because I consider myself to be those things, I also believe in creating real value and the vision for industries to change and improve. And that is what I and my company strive for in the context of pharmacovigilance.

And, it is why I believe the necessary change will best be enabled by shrinking the current size of the field.

What’s next in the second part

The next part will consider the key arguments about the size of PV and why it is estimated (by most) to double over the next 10 years or so.

In short, I will elaborate on the below arguments:

- While the pharmaceutical industry and number of new medicines are likely to grow, it is unlikely to outpace the technological progress and created efficiencies

- Efficiency gains through automation and AI may naturally not translate into cost savings, but in a “compliance field” with a defined “maximum demand’, they should

- Arguments on ageing population and growing number of AE reports may be right, but number of AE reports shouldn’t matter that much for PV budgets in the age of Artificial Intelligence

- If pricing models of providers will be based on value, the total size of PV does not need to grow

- Pharmacovigilance as an industry may shape-shift into other areas such as RWE, and, as such, indeed grow, but then is it still pharmacovigilance?

- Regulators’ actions can directly affect the industry to either grow or shrink, but progress is likely to be very slow

If you don’t want to miss the next part of this article, be sure to follow Tepsivo on Linkedin.

List of resources

References on the current pharmacovigilance market size and forecasts:

– Precedence Research:

Pharmacovigilance Market Size, Share and Trends

– Imarc Group:

– Future Market Insights:

– Nova One Advisor:

Pharmacovigilance Market Size and Growth

– Globe Newswire:

Pharmacovigilance Industry Analysis Report

Did you like the article? Share with your network!

…or tell us your opinion.

Follow our newsletter!

Keep up with industry trends and get interesting reads like this one 1x per month into your inbox.

Learn more about Tepsivo

We deliver modern PV solutions to fulfill your regulatory needs using less resources. See how we do it >

0 Comments